Featured

Table of Contents

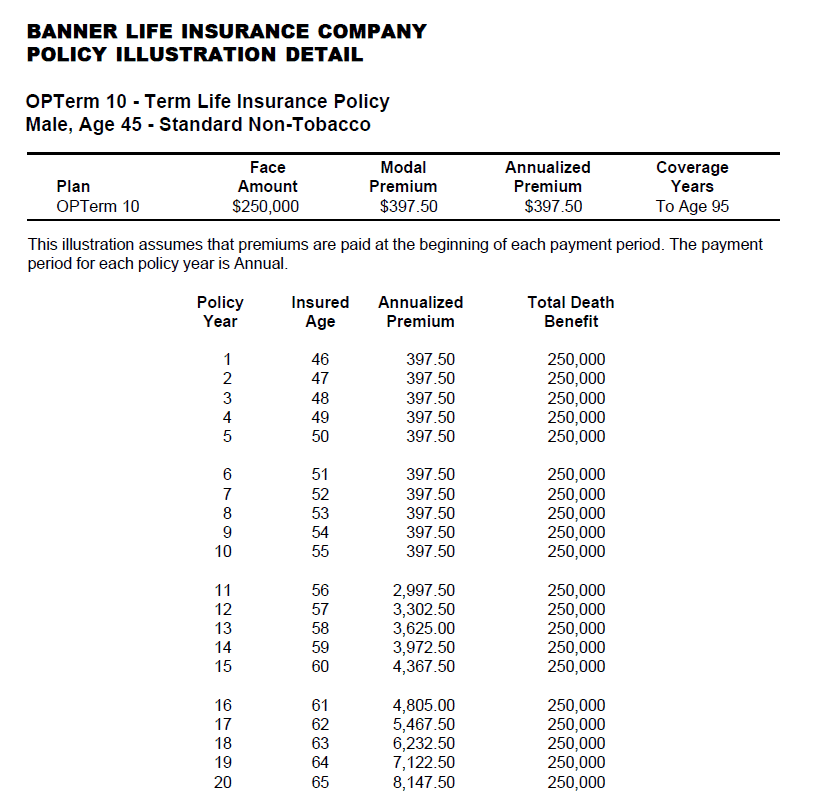

A level term life insurance plan can offer you satisfaction that individuals who depend on you will have a survivor benefit during the years that you are intending to support them. It's a way to assist take treatment of them in the future, today. A degree term life insurance policy (often called level costs term life insurance coverage) policy provides insurance coverage for an established number of years (e.g., 10 or 20 years) while keeping the costs settlements the very same for the duration of the policy.

With degree term insurance coverage, the expense of the insurance coverage will certainly remain the very same (or potentially lower if dividends are paid) over the regard to your plan, usually 10 or twenty years. Unlike irreversible life insurance policy, which never runs out as long as you pay premiums, a level term life insurance coverage plan will certainly finish at some time in the future, normally at the end of the period of your degree term.

How Do You Define Simplified Term Life Insurance?

Due to this, lots of people use permanent insurance policy as a secure monetary planning tool that can offer many requirements. You may be able to convert some, or all, of your term insurance throughout a collection duration, usually the very first one decade of your policy, without needing to re-qualify for protection also if your wellness has actually changed.

As it does, you may intend to add to your insurance coverage in the future. When you initially get insurance policy, you might have little financial savings and a huge home loan. Eventually, your cost savings will certainly grow and your mortgage will certainly diminish. As this takes place, you might want to eventually minimize your survivor benefit or take into consideration converting your term insurance to an irreversible plan.

So long as you pay your costs, you can rest easy understanding that your loved ones will obtain a death benefit if you pass away throughout the term. Many term policies enable you the capacity to convert to permanent insurance coverage without needing to take another health and wellness test. This can enable you to make the most of the additional benefits of a permanent policy.

Level term life insurance policy is among the most convenient courses into life insurance policy, we'll talk about the benefits and disadvantages to ensure that you can choose a strategy to fit your requirements. Level term life insurance policy is the most common and basic type of term life. When you're trying to find momentary life insurance policy plans, degree term life insurance policy is one path that you can go.

The application procedure for degree term life insurance policy is commonly extremely straightforward. You'll complete an application that consists of general personal information such as your name, age, etc as well as a more thorough questionnaire regarding your case history. Depending upon the policy you're interested in, you may need to participate in a medical exam procedure.

The brief solution is no., for instance, let you have the comfort of death advantages and can accumulate money value over time, indicating you'll have a lot more control over your benefits while you're active.

What is Level Premium Term Life Insurance? What You Should Know?

Motorcyclists are optional stipulations contributed to your plan that can offer you extra benefits and securities. Riders are a terrific method to add safeguards to your plan. Anything can take place throughout your life insurance term, and you intend to await anything. By paying just a little bit extra a month, cyclists can supply the support you require in case of an emergency situation.

There are circumstances where these advantages are developed into your plan, yet they can additionally be available as a different addition that needs additional repayment.

Table of Contents

Latest Posts

What is What Is A Level Term Life Insurance Policy? Key Considerations?

How Does Joint Term Life Insurance Policy Work?

What is Term Life Insurance With Accelerated Death Benefit Coverage Like?

More

Latest Posts

What is What Is A Level Term Life Insurance Policy? Key Considerations?

How Does Joint Term Life Insurance Policy Work?

What is Term Life Insurance With Accelerated Death Benefit Coverage Like?