Featured

Table of Contents

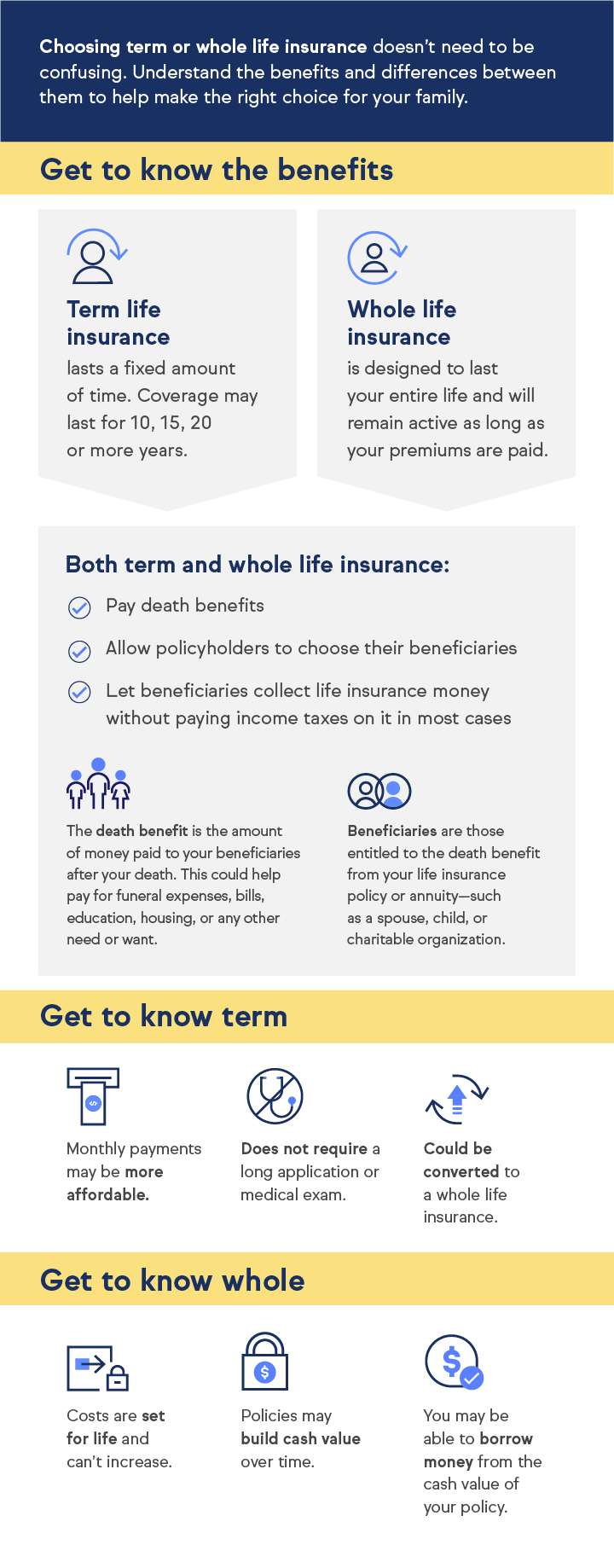

You can obtain against the cash money worth of your plan for things like tuition payments, emergency situations and even to supplement your retired life earnings (Protection plans). Bear in mind, this still is taken into consideration a car loan, and if it's not paid back before you die, then your death benefit is lowered by the amount of the loan plus any outstanding passion

Primarily, a motorcyclist is used to tailor your plan to fit your needs. If you're terminally ill, an increased death advantage biker might pay out a portion of your fatality advantage while you're still alive. You can use the payment for things like clinical expenses, to name a few uses, and when you die, your recipients will receive a decreased life insurance coverage benefit considering that you made use of a portion of the plan already.

This info represents just a brief description of insurance coverages, is not component of your policy, and is not an assurance or assurance of protection.

Insurance coverage plan terms and problems might apply. Exemptions might use to plans, endorsements, or riders. Policy Types: ICC17-225 WL, Policy Form L-225 (ND) WL, Policy Type L-225 WL, Plan FormICC17-225 WL, Plan Kind L-226 (ND) WL, Plan Type L-226 WL, Plan Kind ICC17-227 WL, Policy Form L-227 (ND) WL, Policy Type L-227 WL, ICC21 L141 MS 01 22, L141 ND 02 22, L141 SD 02 22.

How can Riders protect my family?

Death advantages are generally paid in a lump sum settlement., health insurance coverage, and tuition. At least 3 in 4 American adults indicated they have some type of life insurance policy; nevertheless, females (22%) are twice as likely as guys (11%) to not have any kind of life insurance coverage.

This could leave less money to pay for costs. Each time when your liked ones are currently dealing with your loss, life insurance policy can aid ease several of the monetary worries they might experience from lost income after your passing away and help offer a financial safeguard. Whether you have a 9-to-5 job, are self-employed, or possess a small company, your current earnings might cover a part or every one of your household's day-to-day demands.

44% responded that it would certainly take much less than six months to experience monetary hardship if the key breadwinner died. 2 If you were to pass away unexpectedly, your other household participants would certainly still need to cover these recurring household expenses even without your earnings. The life insurance policy fatality advantage can aid replace income and make certain financial stability for your enjoyed ones after you are no more there to attend to them.

Long Term Care

Funerals can be pricey. Handling this monetary anxiety can contribute to the emotional strain your family members could experience. Your family can make use of some of the survivor benefit from your life insurance coverage plan to aid pay for these funeral service costs. The plan's recipient can direct a few of the death benefits to the funeral chapel for last costs, or they can pay out-of-pocket and utilize the survivor benefit as reimbursement for these expenses.

The typical cost of a funeral with burial is nearly $8,000, and for a funeral service with cremation, it's around $7,000. The "Human Life Worth" (HLV) idea refers to life insurance coverage and economic preparation. It represents a person's worth in terms of their monetary payment to their family members or dependents. In other words, if that individual were to drop dead, the HLV would certainly estimate the monetary loss that their household would incur.

Why do I need Legacy Planning?

Eighth, life insurance policy can be used as an estate preparation device, assisting to cover any kind of required estate tax obligations and final costs - Legacy planning. Ninth, life insurance plans can offer particular tax obligation advantages, like a tax-free death advantage and tax-deferred cash money value accumulation. Life insurance policy can be a vital component of protecting the economic protection of your enjoyed ones

Speak with among our financial specialists regarding life insurance today. They can assist you evaluate your requirements and find the right plan for you. Rate of interest is billed on lendings, they might generate an earnings tax obligation responsibility, decrease the Account Value and the Death Benefit, and might create the plan to gap.

Trust Planning

The Federal Government established the Federal Worker' Group Life Insurance Policy (FEGLI) Program on August 29, 1954. It is the biggest group life insurance program in the globe, covering over 4 million Federal workers and senior citizens, in addition to a number of their relative. A lot of employees are qualified for FEGLI coverage.

It does not build up any type of cash value or paid-up value. It includes Standard life insurance coverage and three options. For the most part, if you are a new Federal employee, you are automatically covered by Standard life insurance policy and your pay-roll office subtracts costs from your paycheck unless you forgo the coverage.

You have to have Fundamental insurance in order to choose any one of the alternatives. Unlike Standard, registration in Optional insurance coverage is manual-- you should do something about it to elect the choices (Retirement planning). The cost of Fundamental insurance policy is shared in between you and the Government. You pay 2/3 of the overall price and the Federal government pays 1/3.

Who provides the best Death Benefits?

You pay the complete price of Optional insurance coverage, and the cost depends on your age. The Office of Federal Personnel' Team Life Insurance (OFEGLI), which is a personal entity that has an agreement with the Federal Federal government, procedures and pays claims under the FEGLI Program.

Possibilities are you might not have sufficient life insurance protection for on your own or your loved ones. Life occasions, such as obtaining wedded, having kids and buying a home, may cause you to need more security.

You can enlist in Optional Life insurance and Dependent Life-Spouse insurance throughout: Your initial registration; Open up enrollment in October; orA unique qualification circumstance. You can enlist in Reliant Life-Child insurance coverage throughout: Your first enrollment; orAnytime throughout the year.

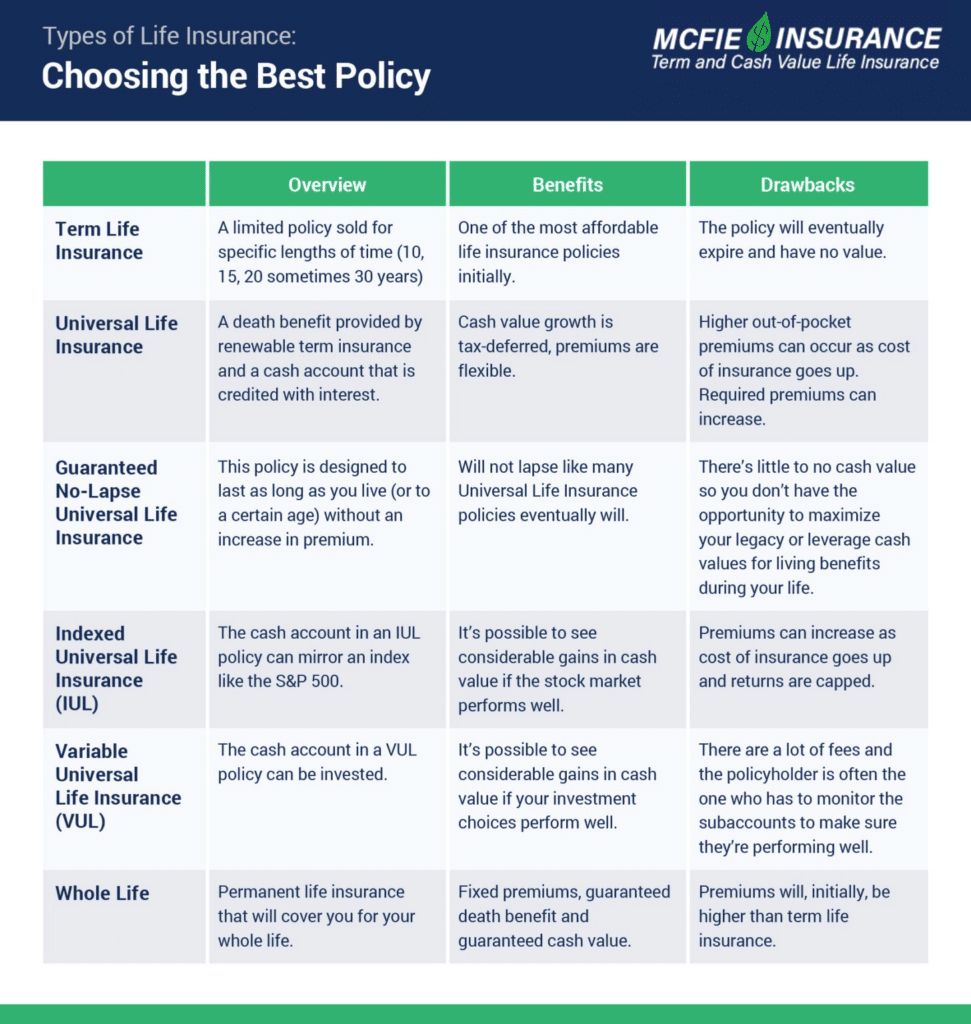

You might want to think about life insurance policy if others depend on your income. A life insurance policy, whether it's a term life or whole life policy, is your individual home.

How do I compare Death Benefits plans?

Here are several cons of life insurance policy: One disadvantage of life insurance policy is that the older you are, the more you'll pay for a plan. This is because you're most likely to die during the policy duration than a more youthful insurance holder and will, consequently, set you back the life insurance policy business even more cash.

Latest Posts

Life Insurance For Funerals

Final Expense Insurance Delaware

State Farm Final Expense Life Insurance